North America's Surge in Defense and Space Technology Investment

- Tania Tugonon

- Dec 16, 2025

- 4 min read

Updated: Jan 8

North America has emerged as the epicenter of private capital flow into defense and space technology. What once was a slow trickle of early-stage interest has transformed into robust strategic investment from both traditional venture firms and corporate venture arms tied to major defense and aerospace players.

VC Momentum in Defense Tech

Venture investment in defense and aerospace startups has climbed from just over $10 billion in 2024 to more than $19 billion in 2025 (as of late November) — nearly doubling year over year, per PitchBook. This reflects a substantial expansion in funding over the last year as startups close significant funding rounds and attract diversified capital sources.

VC activity in defense tech is not limited to Silicon Valley generalists. Corporate venture capital from primes and strategic industrial partners is increasingly active. They offer not just capital but also alliances that help startups navigate complex defense procurement and integration pathways.

Early-stage deals have also surged. In Q1 2025, venture firms deployed $1.78 billion into 24 defense tech deals. This marks an 82% increase quarter-over-quarter, highlighting strong conviction in the sector’s prospects.

The Rise of Dual-Use and Strategic Alignment

A defining trend in North America is the rise of dual-use technologies. These solutions are intentionally designed to serve both defense requirements and commercial markets. This includes autonomous systems, AI-enabled sensing, and secure communications. Startups that can demonstrate applicability in both domains tend to attract broader pools of capital and strategic interest.

The Silicon Valley Defense Group’s 2025 NatSec100 report highlights how dual-use companies are driving innovation. They are jointly supported by VC and defense stakeholders, signaling a maturing ecosystem where capital and national security interests align.

Space Tech Keeps Scaling with Strategic Capital

North America remains the leading region for space tech VC. As of Q2 2025, venture capital investment in space startups reached approximately $3.3 billion, reflecting a recovery from the prior year’s pullback. Capital is returning to earth observation, satellite infrastructure, and in-orbit services.

This funding environment has fueled growth in startups that serve both commercial and national security end markets. Space infrastructure, such as satellite broadband and ISR (intelligence, surveillance, reconnaissance) platforms, continues to attract capital. This is due to its dual role in economic and defense ecosystems.

Strategic Corporate VC Shapes the Landscape

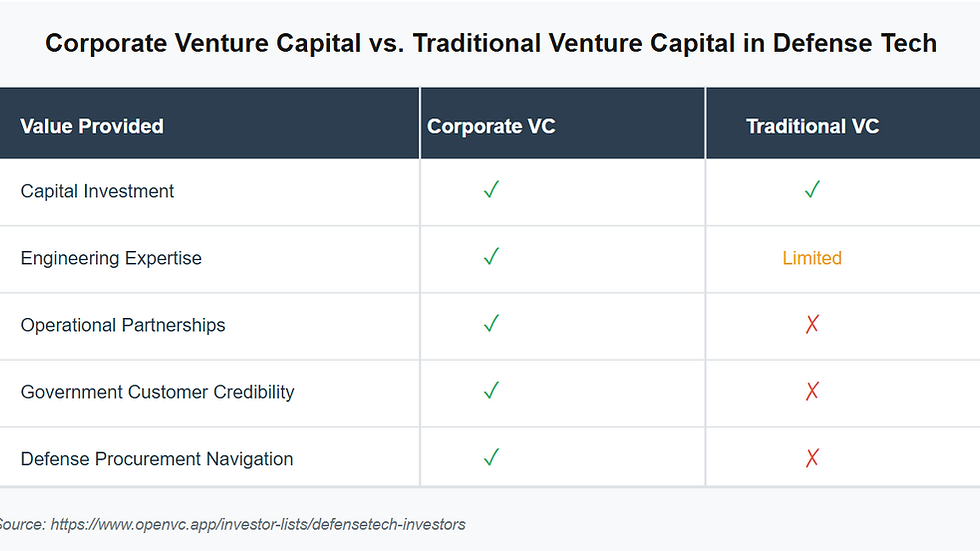

Corporate venture arms from aerospace and defense primes are actively deploying capital and strategic resources. These CVCs provide more than funding; they offer engineering expertise, operational partnerships, and credibility with government customers that pure financial investors often lack.

This trend reflects a broader shift in how capital is sourced and applied in the sector. Corporate VC is becoming a bridge between deep technology innovation and national security deployment. As defense acquisition practices evolve, and the U.S. Department of Defense signals openness to non-traditional suppliers, strategic capital will play a key role in scaling emerging tech.

The Future of Investment in Defense and Space Tech

The landscape of defense and space technology investment is evolving rapidly. As we move forward, several factors will influence this growth.

Technological Advancements

Technological advancements will continue to drive investment. Innovations in AI, machine learning, and robotics are reshaping the defense sector. These technologies enhance operational efficiency and effectiveness. They also create new opportunities for startups to enter the market.

Regulatory Changes

Regulatory changes will also play a significant role. Governments are increasingly recognizing the importance of private sector involvement in national security. This shift may lead to more favorable policies for startups in the defense and space sectors.

Global Collaboration

Global collaboration is another key factor. As threats become more complex, countries are working together to address security challenges. This collaboration can open doors for startups that provide innovative solutions.

About Axis Group Ventures

Axis Group Ventures is a boutique investment banking and strategic advisory firm. We focus on global debt placement and private market secondaries for venture- and private equity-backed companies. Our firm partners with founders, CFOs, and investors to provide customized capital solutions in the private markets. We leverage deep experience in private credit and a global network of capital providers. Axis Group Ventures’ mission is to bring greater transparency and alignment to complex financing decisions through disciplined, independent advisory and high-touch execution. For more information, visit www.axisgroupventures.com.

Sources

https://www.businessinsider.com/defense-tech-vc-funding-rounds-2025-11?utm

https://www.openvc.app/investor-lists/defensetech-investors?utm

https://pitchbook.com/news/reports/2025-vertical-snapshot-defense-tech?utm

https://www.siliconvalleydefense.org/initiatives/2025natsec100pressrelease?utm

https://www.kennox.ai/industry-news/space-venture-capital-q3-2025-investment-update?utm

https://www.openvc.app/investor-lists/defensetech-investors?utm

Disclosures & Disclaimers

This blog post is provided by Axis Group Ventures for informational and educational purposes only. It does not constitute investment, legal, accounting, or tax advice, and should not be relied upon as such. Nothing contained here should be interpreted as an offer to buy or sell any securities. Any actual offer or solicitation will be made exclusively through formal documentation provided by the relevant issuer or seller.

Axis Group Ventures is not a registered broker-dealer and does not execute, negotiate, or recommend the purchase or sale of securities. Any introductions or private-market support provided by Axis Group Ventures are conducted strictly in an advisory and consulting capacity. Readers should conduct their own due diligence and consult qualified professionals before making any financial decisions.

Investments in private securities involve significant risks, including the potential loss of the entire investment, and are typically illiquid. Past performance does not guarantee future results.

Comments